THE council has defended itself against accusations it is forcing people into bankruptcy.

An investigation by Creditfix, a national personal insolvency practice, found that Cheshire West and Chester Council (CWaC) is one of 55 local authorities in England and Wales that are said to reject Individual Voluntary Arrangements (IVAs).

IVAs offer an alternative to bankruptcy by allowing people to use an insolvency practice to pay off their debts, including council tax, over time.

But they rely on all creditors agreeing to the arrangement – and Creditfix says CWaC is not allowing people to take advantage of them.

Slamming the policy, Taylor Flynn, head of marketing at the company, said it was counter-productive to push people towards bankruptcy.

He said: “At a time when local authorities are increasingly cash-strapped, it seems absurd that Cheshire West and Chester Council would not consider IVAs as a repayment option.

“Of course, creditors (councils or otherwise) seek to claim back what is owed – but the cost of taking someone to court, employing bailiffs and potentially re-housing families made homeless through bankruptcy is enormous.

“More than anything, it sends out the wrong message to people who are taking responsibility for their money problems and turning their lives around, rather than burying their heads in the sand.”

He added: “With 55 local authorities rejecting IVAs, compared to 64 that accept them, struggling householders are being penalised, simply because they live in a certain area.

“Unlike bankruptcy, debt solutions like IVAs give people a better chance of keeping their job and home, so they are able to contribute, and I’d urge all councils to consider them.”

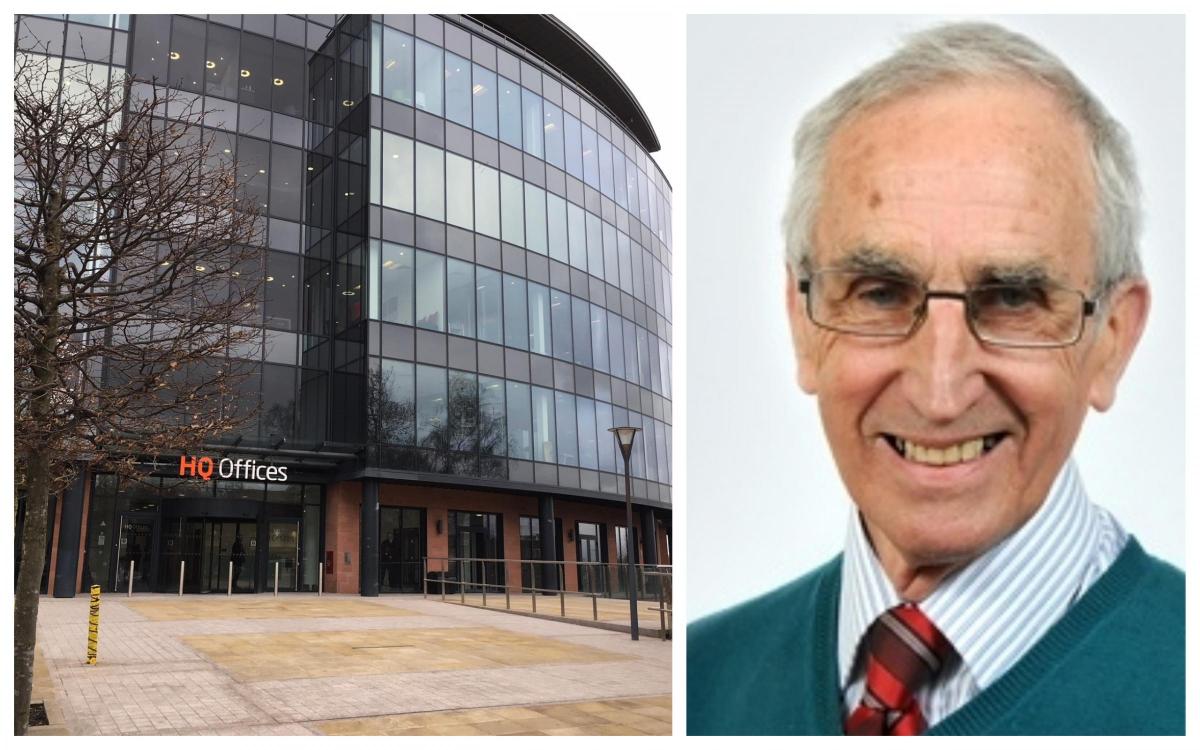

However, Cllr David Armstrong, cabinet member for legal and finance at CWaC, said the council does not reject all IVA requests.

“We have a firm but fair approach when we are recovering owed council tax,” he said.

“We don’t reject all requests for individual voluntary arrangements, but we do review each case individually on its merits before we make a decision.

“We also work proactively with all customers to recover owed council tax, providing a range of options so they incur as little additional costs as possible.”

Regulated by the Financial Conduct Authority, thousands of people reportedly complete IVAs every year to pay off large unsecured personal debts.

The debt solution, introduced as part of the Insolvency Act 1986, needs approval from all creditors, including the council if council tax arrears have contributed to the unsecured debt.

The Government’s definition of an IVA is “an agreement with your creditors to pay all or part of your debts. You agree to make regular payments to an insolvency practitioner, who will divide this money between your creditors.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here